The Ultimate List for Browsing Your Credit Repair Trip

Wiki Article

The Key Advantages of Debt Repair Service and Its Effect On Your Car Loan Eligibility

In today's economic landscape, comprehending the ins and outs of credit history fixing is important for any person looking for to boost their loan qualification. By resolving common credit history record errors and improving one's credit rating, individuals can open a range of advantages, including access to a lot more positive loan alternatives and interest rates.Recognizing Credit History

Credit report are an essential element of individual financing, acting as a numerical depiction of a person's credit reliability. Normally ranging from 300 to 850, these ratings are calculated based upon various elements, including repayment background, credit report usage, size of credit report, kinds of credit history, and current inquiries. A higher credit history shows a reduced danger to loan providers, making it less complicated for individuals to secure car loans, charge card, and desirable rate of interest.Recognizing credit rating scores is necessary for efficient monetary monitoring. A score over 700 is normally taken into consideration great, while scores listed below 600 may hinder one's ability to acquire credit scores.

Regularly keeping track of one's debt rating can offer understandings right into one's monetary wellness and emphasize areas for renovation. By keeping a healthy credit report, people can enhance their financial opportunities, secure much better car loan problems, and ultimately accomplish their economic objectives. Hence, a detailed understanding of credit report is essential for any individual looking to navigate the intricacies of personal money properly.

Usual Credit History Record Mistakes

Mistakes on credit reports can considerably impact an individual's credit rating and total monetary wellness. These mistakes can occur from numerous sources, including information entry blunders, dated info, or identification burglary. Common kinds of errors consist of wrong personal details, such as wrong addresses or misspelled names, which can cause confusion pertaining to a person's credit report.One more constant problem is the misreporting of account conditions. For instance, a closed account might still show up as open, or a timely repayment might be incorrectly taped as late. Furthermore, accounts that do not come from the person, commonly as a result of identification theft, can significantly distort credit reliability.

Duplicate accounts can likewise produce inconsistencies, resulting in inflated debt degrees. Moreover, obsolete public records, such as personal bankruptcies or liens that should have been removed, can remain on credit scores reports longer than allowable, negatively influencing debt ratings.

Provided these potential risks, it is essential for people to regularly assess their credit rating reports for errors. Determining and remedying these mistakes immediately can assist keep a much healthier credit score profile, eventually affecting finance eligibility and securing beneficial rate of interest prices.

Advantages of Debt Repair

In addition, a more powerful credit scores ranking look at these guys can bring about boosted access to credit scores. This is particularly beneficial for those wanting to make significant acquisitions, such as homes or lorries. Having a healthy and balanced credit rating can reduce the need or eliminate for safety down payments when establishing or signing rental contracts up energy solutions.

Beyond instant economic benefits, individuals that involve in credit score repair can likewise experience a renovation in their general financial literacy. As they find out more regarding their credit rating and monetary monitoring, they are much better equipped to make informed choices relocating onward. Inevitably, the benefits of credit scores repair work prolong beyond numbers; they foster a feeling of empowerment and stability in personal finance.

Influence On Loan Eligibility

A strong credit score account substantially influences financing qualification, impacting the terms and problems under which lending institutions want to accept applications. Lenders use credit rating and records to examine the threat related to offering to an individual. A higher credit rating usually correlates with better loan alternatives, such as reduced rate of interest and a lot more desirable repayment terms.Alternatively, a bad credit rating background can result in greater rate of interest, larger deposit requirements, or outright loan denial. Credit Repair. This can hinder a person's ability to safeguard essential financing for significant purchases, such as cars or homes. A suboptimal credit report profile may limit accessibility to numerous types of car loans, consisting of personal loans and credit rating cards, which can even more continue economic troubles.

By dealing with mistakes, clearing up exceptional financial obligations, and establishing a favorable repayment history, individuals can improve their debt ratings. Recognizing the influence of credit report health on loan qualification highlights the relevance of positive debt monitoring strategies.

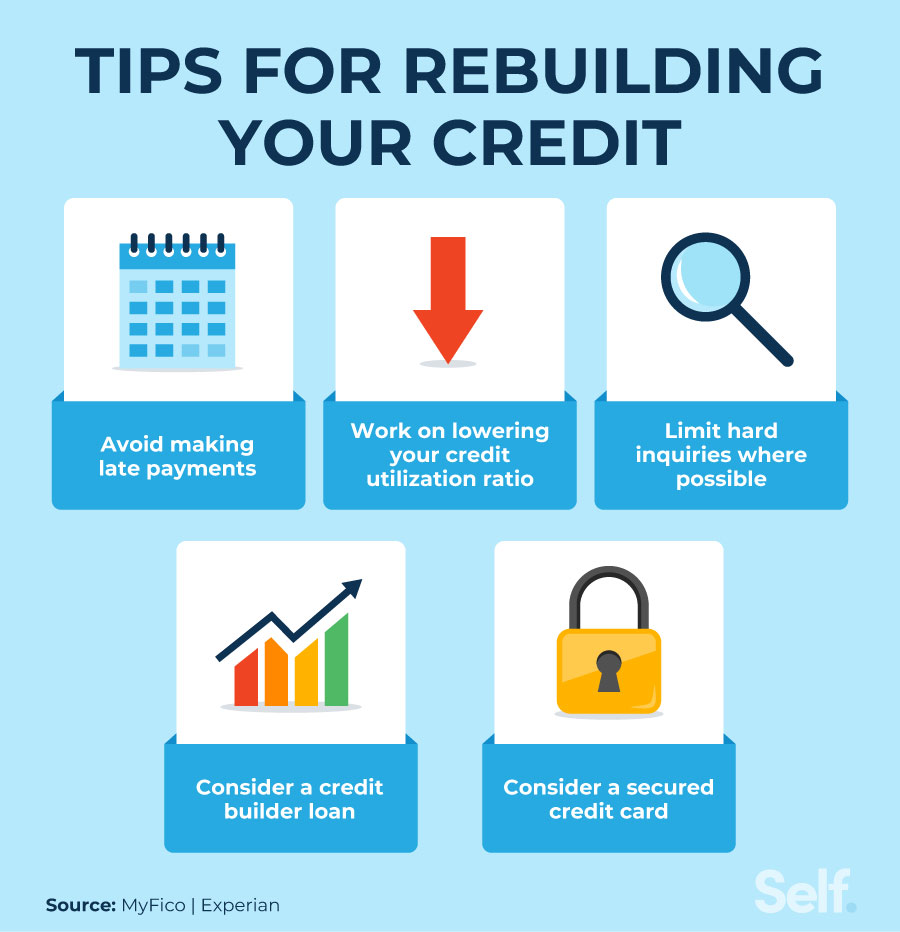

Actions to Begin Credit Rating Repair

Countless individuals seeking to enhance their credit rating can take advantage of a structured approach to credit rating repair work. The primary step involves obtaining a duplicate of your credit history record from all 3 major credit history bureaus: Experian, TransUnion, and Equifax. Evaluation these records for inconsistencies or inaccuracies, as errors can adversely influence your rating.Following, identify any type of impressive financial debts and prioritize them based on necessity and quantity. Call creditors to bargain settlement strategies or negotiations, which can be a crucial action in demonstrating responsibility and dedication to resolving financial debts.

When errors are identified, data conflicts with the credit bureaus - Credit Repair. Provide documentation to sustain your claims, as this might expedite the elimination of incorrect access

In addition, develop a budget to guarantee prompt settlements progressing. Constant, on-time settlements will dramatically boost your credit history over time.

Lastly, consider looking for expert help from a credible credit repair work firm if do it yourself methods prove frustrating. While this may sustain additional costs, their proficiency can improve the procedure. By adhering to these steps, people can efficiently enhance their credit rating profile and lead the way for far better funding qualification.

Verdict

To conclude, credit rating repair service functions as an important tool for boosting credit history and improving loan eligibility. By dealing with usual credit report errors and advertising economic proficiency, people can achieve much better funding alternatives and positive repayment terms. The overall influence of debt repair work prolongs beyond immediate economic advantages, promoting long-lasting financial security and notified decision-making. Hence, participating in credit rating repair represents a proactive method to securing a more try this site beneficial economic future.By resolving typical credit history report mistakes and improving one's credit history rating, people can unlock an array of advantages, including access to a lot Related Site more positive financing alternatives and rate of interest rates. Typically ranging from 300 to 850, these ratings are determined based on numerous factors, including payment background, credit application, length of credit report history, types of credit report, and current inquiries. A greater credit report rating shows a reduced threat to loan providers, making it easier for individuals to protect loans, credit history cards, and favorable passion prices.

Improved credit report ratings frequently result in much more beneficial passion rates on car loans and credit scores products.In verdict, credit score repair work offers as an important device for improving credit report ratings and enhancing lending qualification.

Report this wiki page